Instant Profit Assessment / Profit First Assessment

Jump to:

What is an Instant Profit Assessment?

An Instant Profit First Assessment is a quick checkup of a business’s finances using the Profit First approach. It helps to see if the company is making enough profit and where they can improve. During the assessment, a financial expert looks at the company’s financial statements and records to find areas where they could save money and make more profit. Then, they provide easy-to-understand suggestions on how to use the Profit First strategy to increase profits. Overall, the assessment helps businesses quickly understand their finances and find ways to make more money.

Why Should You Do an Instant Profit Assessment?

Thinking of doing an Instant Profit First Assessment for your business? It’s a quick and easy way to get a better handle on your finances, and there are plenty of benefits to be had!

Firstly, an assessment can help you see your business’s financial health more clearly. By reviewing your records, a financial expert can help you spot areas where you’re losing money, and suggest changes to improve your bottom line.

Speaking of improving your bottom line, an assessment can also help you increase your profit margins. With Profit First principles, you can prioritize profit over revenue and make more money with the same amount of sales.

And let’s not forget about cash flow leaks. These sneaky little things can really eat into your profits, but an assessment can help you identify them and fix them up.

Plus, an assessment can help you plan for the future. By identifying areas where you can make changes to improve profitability, you can set your business up for long-term success.

So, if you’re looking to boost your business’s financial performance, an Instant Profit First Assessment could be just what you need!

Access the PDF version HERE

Other Ways To Do an Instant Profit Assessment?

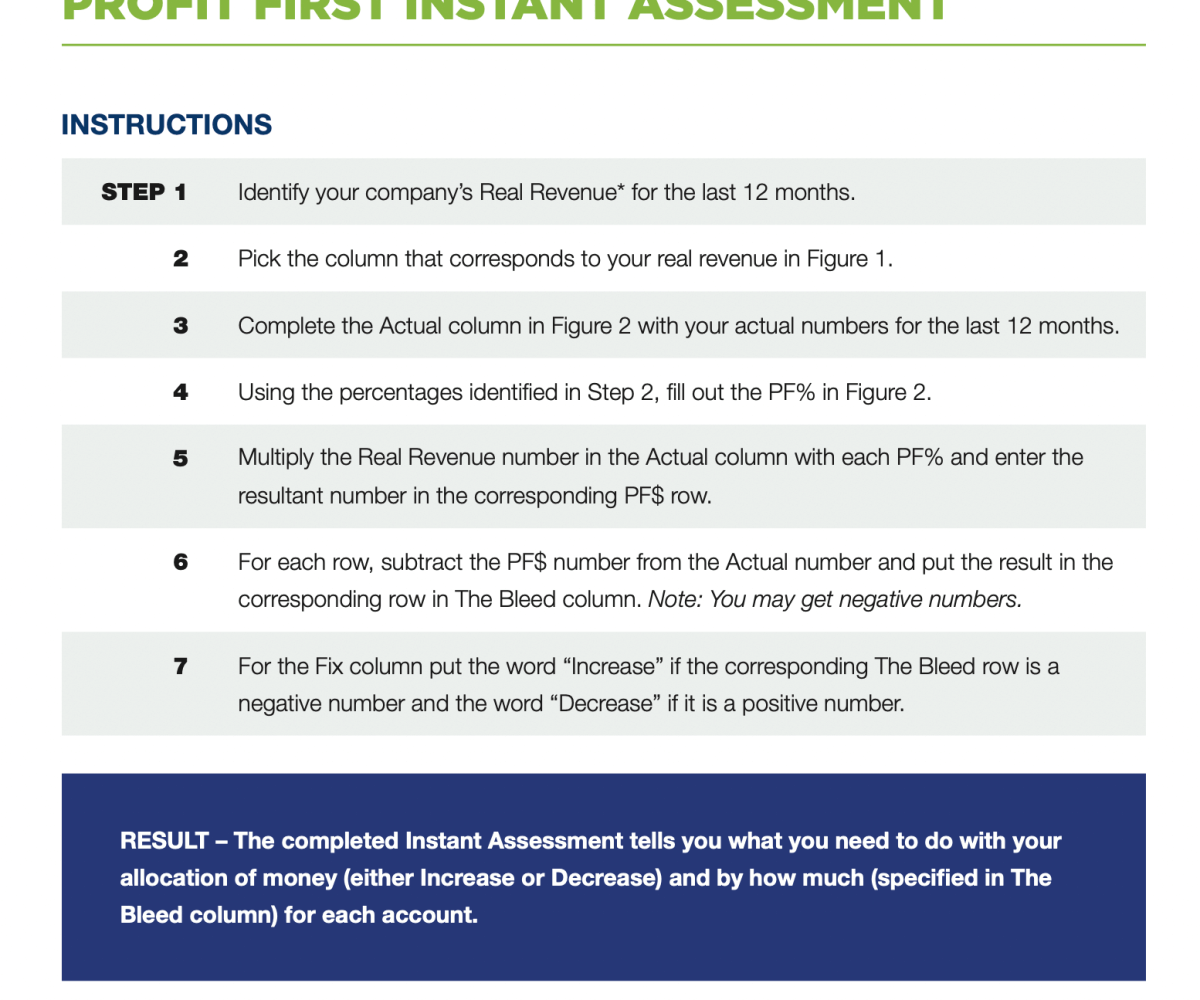

Doing an Instant Profit First Assessment for your business is a simple process. Here are the basic steps:

- Gather Your Financial Records: Start by gathering all your business’s financial records, such as bank statements, credit card statements, and income and expense reports. This will give you a good overview of your current financial situation.

- Review Your Records: Go through each record carefully and look for any patterns or trends. For example, are there certain expenses that are higher than they should be? Are there areas where you’re consistently losing money?

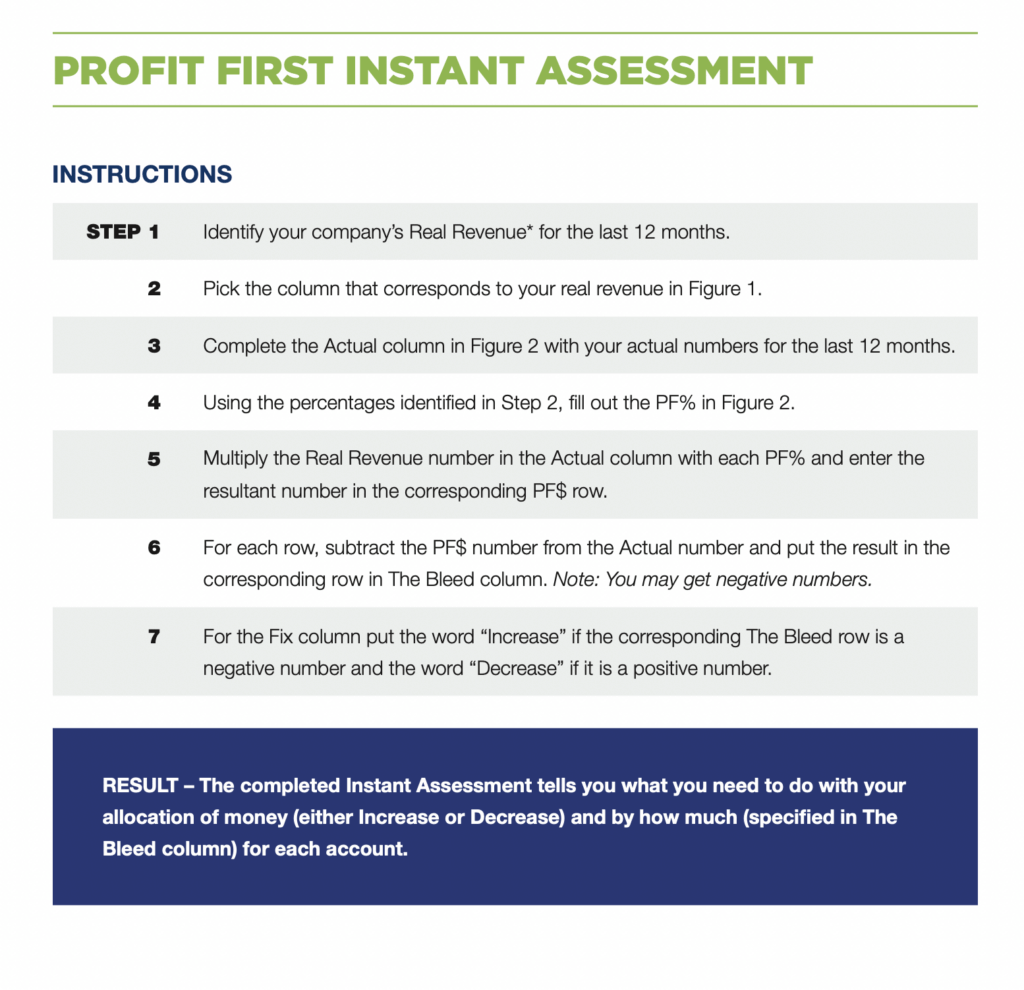

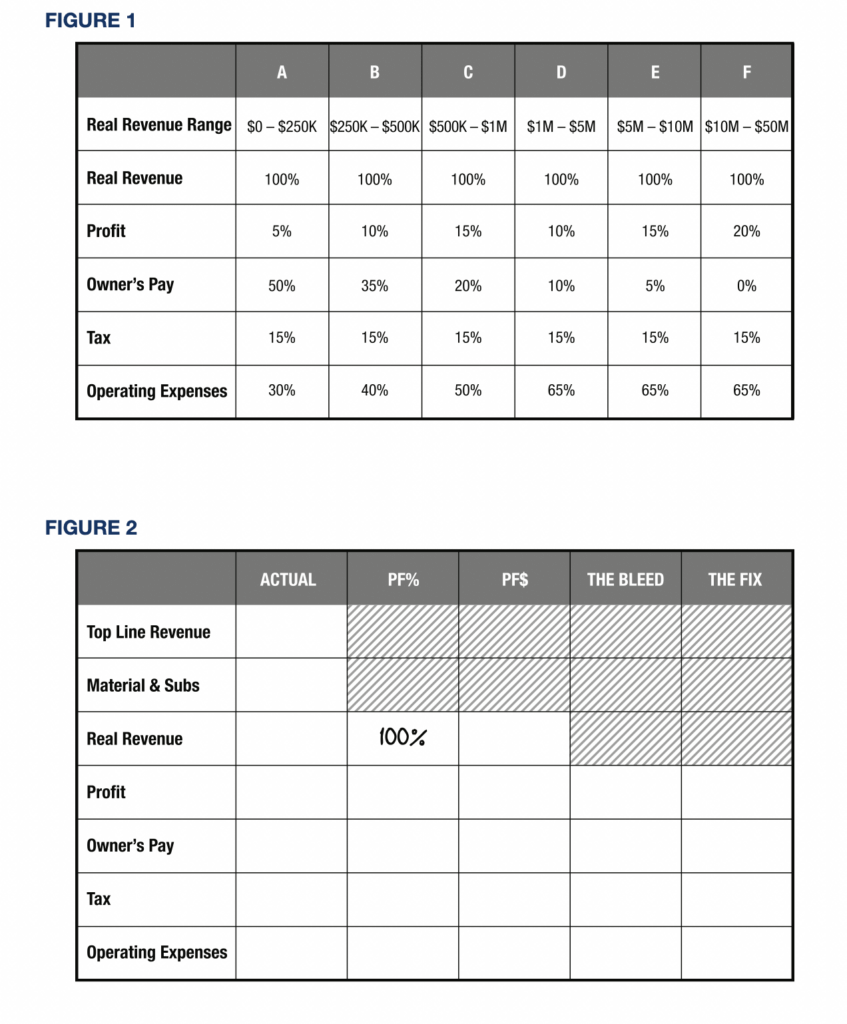

- Identify Your Profit First Categories: Next, identify your Profit First categories. These are the different accounts you’ll use to manage your cash flow, such as your income account, profit account, tax account, and operating expenses account.

- Allocate Your Funds: Once you’ve identified your Profit First categories, allocate your funds accordingly. This means putting a certain percentage of your income into each account to ensure you’re prioritizing profit and managing your cash flow effectively.

- Get Expert Advice: Finally, it’s a good idea to get expert advice from a financial professional or Profit First Certified Professional. They can help you identify any areas where you can improve your profitability and provide customized recommendations for your business.

Overall, an Instant Profit First Assessment is a great way to get a better understanding of your business’s finances and make changes to improve your bottom line. By following these steps, you can start managing your cash flow more effectively and prioritize profit in your business.

Need More Help with Profit First?

Are you struggling to make more profit and manage your cash flow effectively? If so, it’s time to get some help from the experts!

At CTA Profit First Accountants, we’re certified Profit First Professionals with a track record of helping businesses just like yours improve their financial performance. With our guidance and expertise, you can start making more cash and profit in no time.

We understand that managing your finances can be overwhelming, especially when you’re trying to grow your business at the same time. That’s why we offer customized solutions tailored to your unique needs and goals. Whether you’re just starting out or have been in business for years, we can help you implement Profit First principles and start seeing results.

Our team of experienced accountants and financial advisors can provide a range of services, including financial assessments, cash flow management, profit planning, and more. We’re committed to helping you achieve your financial goals and make your business as profitable as possible.

So, if you’re ready to take your business to the next level, contact CTA Profit First Accountants today. We’ll work with you every step of the way to ensure you’re maximizing your profits and achieving long-term financial success.