Coaching for Accountants

1-1 transformational coaching for accountants to create a business than can run without you. This is not 1 to many, it is a high impact 1-1 action based programme to DRIVE RESULTS.

Jump to:

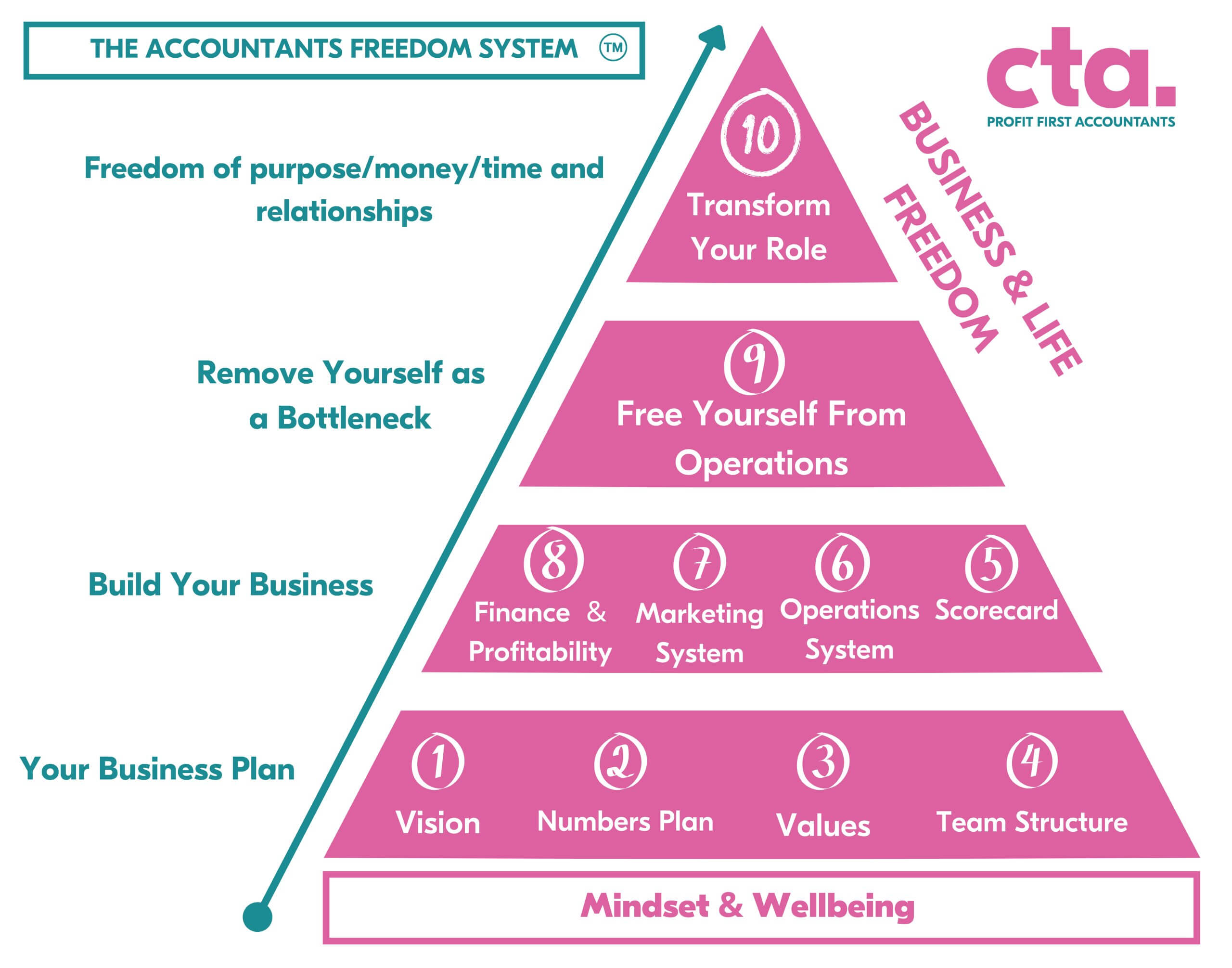

The Accountants Freedom System (AF System)

Welcome to a new perspective on your business, one where your accountancy practice is set up to deliver the life you want. One where your business doesn’t merely require your presence to function, but operates seamlessly with or without you. This isn’t a distant dream. It’s the reality within reach through the Accountants Freedom System (AF System).

In fact, I have managed to create this in my own business. in May of 2023, I took 5 weeks off from my business to celebrate my 40th Birthday with my family. I challenged myself to do this as it was ‘Clockworking’ my business. I realised that this was not a normal thing that most business owners could do and especially accountancy businesses. I see it over and over again, most practice owners still see themselves as accountants first and business owners second.

The AF System is my brainchild that has been 10 years in the making. This proven roadmap is an amalgamation of a decade’s worth of experience, firsthand challenges, and real-world triumphs I have experienced.

I have been around so many accountancy mentoring and masterminds groups but am yet to find a programme that treats accountants as business owners and unlocks their true potential. There is too much noise in the industry, software companies, ‘mastermind’ groups and marketers all want your money. They see accountants as an easy sell because we can apparently afford it. In my experience, many accountants are suffering through either not earning their commercial worth or simply working too long and too hard in ‘grinding’ mode.

My mission is to transform your business and life.

Nine Pillars. Three Stages.

The AF System is anchored in nine robust pillars divided into three transformative stages:

Your Business Plan & Vision

Your Vision and End Game

Craft a compelling business vision and determine your ultimate goals.

Your Numbers Plan

Gain an in-depth understanding of your financial landscape for informed decision-making.

Building Your Business

Your Ideal Team Structure and Values

Identify the perfect team structure and establish core values to drive your team forward.

Your Scorecard

Establish key performance indicators to monitor business progress and team performance.

Your Marketing System

Develop a robust marketing strategy to attract your ideal clients and grow your practice.

Your Operating System

Build efficient operational processes for streamlined business functions.

Your Finance System

Set up a solid financial system for better cash management and profit maximization.

Removing Yourself as the Bottleneck

Creating an Operations Team

Formulate a reliable team capable of running daily operations without you.

Transforming Your Role into the Visionary

Shift from daily operations to strategic planning and business growth.

Finally, by implementing these stages, you unlock the ultimate goal – Business and Life Freedom, granting you the power of choice and control over your time.

Experience Tailored 1-1 Coaching with Stephen Edwards

Working with myself on a 1-1 basis isn’t about adopting a general solution; it’s about personalized guidance, fine-tuned to fit your unique needs. This is not wishy-washy talk, this is all about getting MASSIVE RESULTS AS FAST AS POSSIBLE.

I will help you navigate the implementation of the AF System in your accountancy practice right by your side, equipping you with the necessary tools, strategies, and mindset to foster a self-sustaining business and even self-growing business (let’s save that for another day!)

Book a chatReady for Your Transformation Journey?

Picture a business that not only survives but thrives without your constant presence. That’s the power of the AF System. With this transformative framework, you’re not just running a business; you’re building a legacy. This is not just an off-the-shelf system, it is a 1-1 coaching programme to transform your life where I will do what it takes to make it work for you.

The most significant investment you can make is in yourself and your business – and the time to invest is now.

Get Started