How To Do Bookkeeping

Jump to:

- How To Do Your Own Bookkeeping For a Small Business

- What is bookkeeping

- Discovery Call

- How do I do self-employed bookkeeping?

- When should I use bookkeeping software instead of spreadsheets?

- Bookkeeping for a limited company

- Free Bookkeeping Training / Course

- Bookkeeping for property landlords

- Why use an online tax accountant?

- Book a free call now

How To Do Your Own Bookkeeping For a Small Business

How to do your own ‘bookkeeping’ or bookwork? Stephen Edwards is the founder and director of Cheltenham Tax Accountants. In this blog post we will discuss what bookkeeping is and how you can do this yourself

What is bookkeeping

Before we dive into the detail let’s first have a quick look at what bookkeeping or bookwork actually is. Some of our clients that do their own bookkeeping think that this just means putting some invoices receipts into a file! Let’s be clear that this is not bookkeeping this is filing. Bookkeeping requires traditionally some form of entering or recording the transactions of your business either manually or now most commonly in a digital format. The end result you are looking for is for all of your transactions to be accounted for and categorised into the relevant expense and income categories.

Discovery Call

Before we dive into the detail please note that you are more than welcome to book a free discovery call so that we can answer any specific questions that relate to your business.

How do I do self-employed bookkeeping?

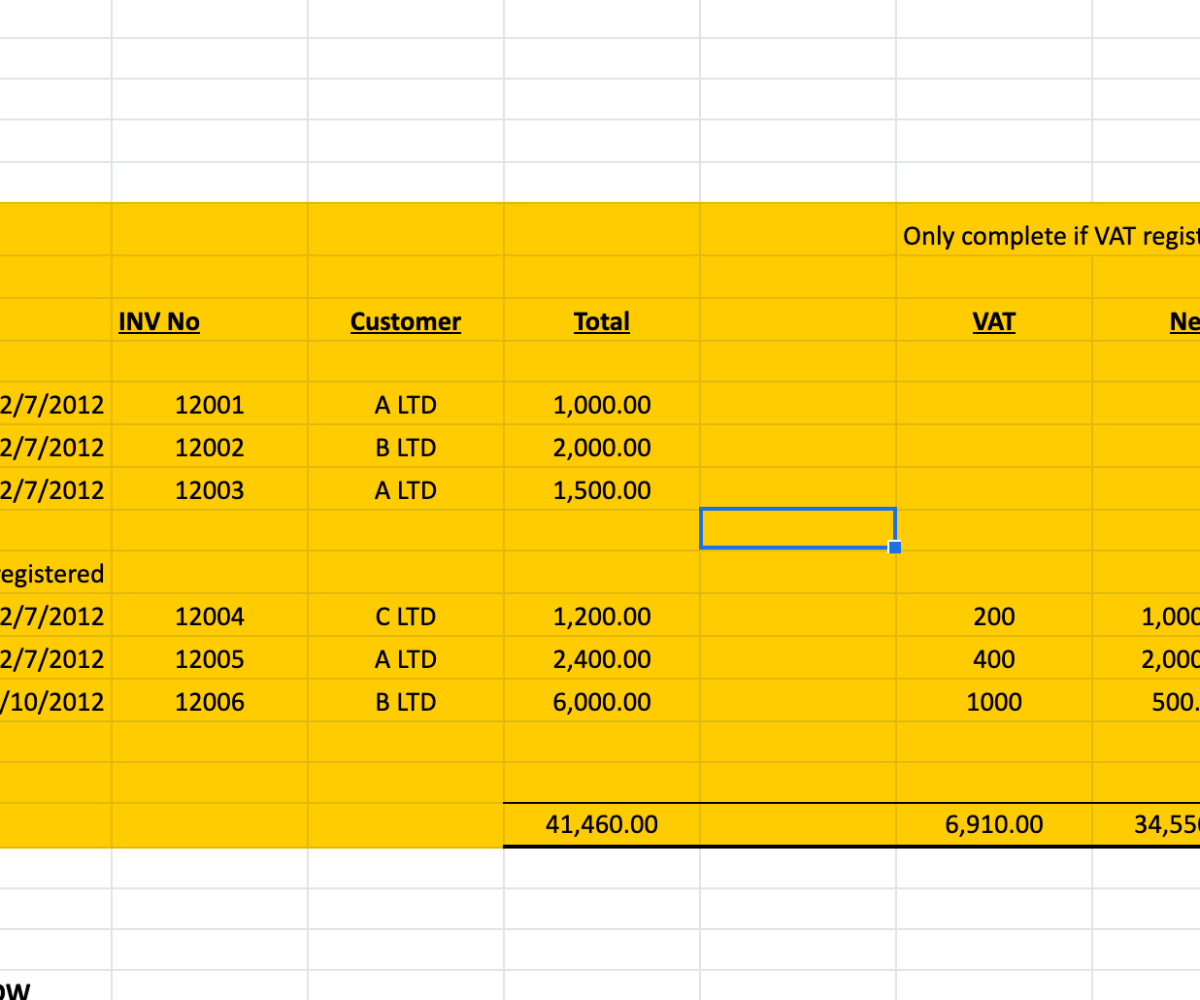

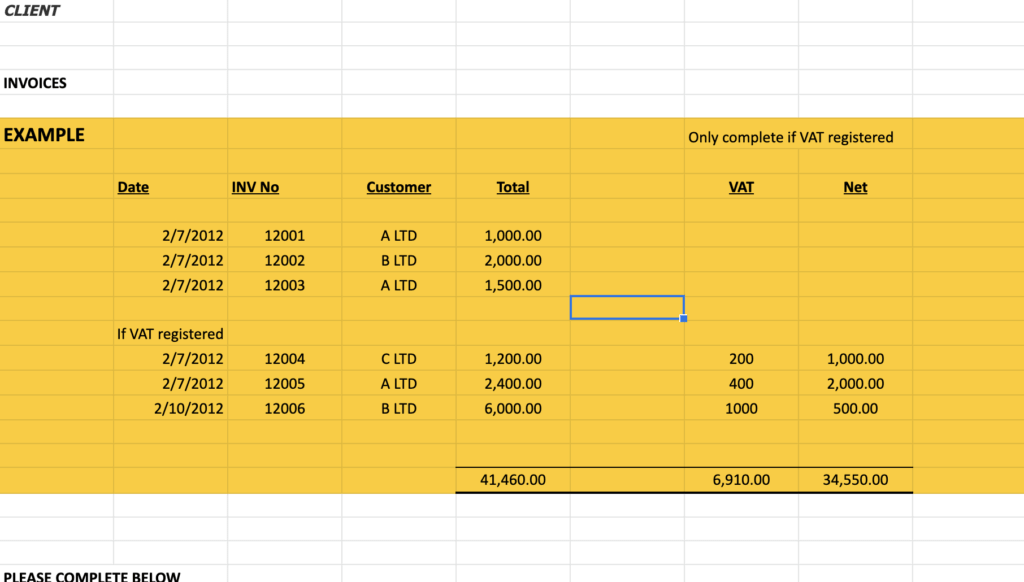

The good news is for the self-employed your bookkeeping requirements are simplified (versus bookkeeping for a limited company). As a self-employed person all you need to do in most circumstances is keep a log of your income and expenses without necessarily having to worry about how these were paid. In short you will not always need to do a bank reconciliation which makes the bookkeeping easier. Please see the example of using a spreadsheet.

The big question you probably have is it what about software? We love online bookkeeping software such as Xero or QuickBooks. In most cases there are many benefits to using such software such as continuous updates, the ability to link directly to your bank statements if required, the ability to create invoices, the ability to save receipts digitally and more.

When should I use bookkeeping software instead of spreadsheets?

The taxman is slowly but surely driving small businesses to keep in digital bookkeeping records. So the short answer is as soon as possible! It is easier to discuss when we feel you can get away with not using software. In some cases if you are a very small business just starting out, you are self-employed, you are not VAT registered, you have a very low volume of transactions then software may not be required at this early stage of your business. However there are still benefits to using software as it will help you scale as the business grows into the future.

Bookkeeping for a limited company

The bookkeeping requirements for a limited company are often far more comprehensive. In a nutshell, you will be required to account for where the money has been paid from or to as well as classifying it. This means that in 90% of cases we will recommend software again such as Xero or QuickBooks. The only potential situation where we would not is if you are a one-man-band contractor and have a very minimal transaction volume with the element of uncertainty into your first year of trading. When using software online you would typically link your online bank account to the software which will then import the transactions at least every other day. These transactions will show up within the software as unreconciled transactions which means they simply need to be accounted for. You can go through the transactions line by line but there are certain features that can help improve the efficiency of this such as creating rules where the software remembers how you treated previous transactions.

Free Bookkeeping Training / Course

Bookkeeping for property landlords

The bookkeeping requirements for property businesses and property landlords are essentially no different to that is discussed above. One main consideration for property investors may be the need to separate your bookkeeping requirements into the different projects and properties to get an idea on your return of investment and individual tax responsibilities. The same can also be said for businesses. For example if you are a builder that also offers electrician services you may want to report this element of your revenue separately.

Why use an online tax accountant?

Let us be clear, we believe strongly in building longer-term trusting client relationships. Technology is an opportunity to streamline businesses and laborious tasks as well as automating them in some cases.

Our belief is that technology is only there to provide a better and more efficient service (whether that is online or offline) to our clients. We understand that you have a busy life and want to maximise your tax savings without the need for it to be a long and time-consuming process. That’s why we exist!