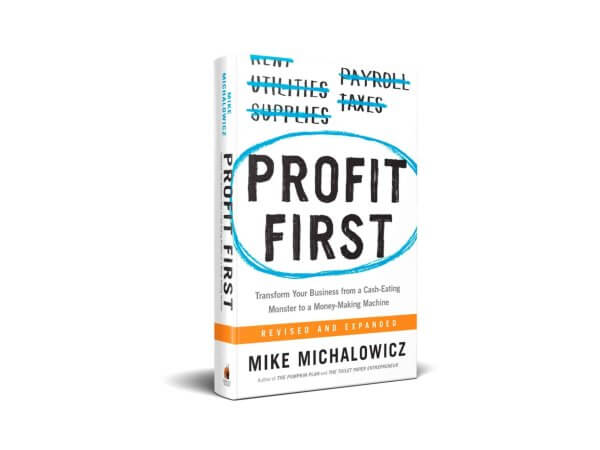

More cash, more profit

We are Official Profit First Accountants. With our Profit First Programme you could see profits increase from 10% to 300% as well as cash in your bank.

Get your free copy of Profit First!

Start today

Filter by:

7th April 2024 · 3 min Read

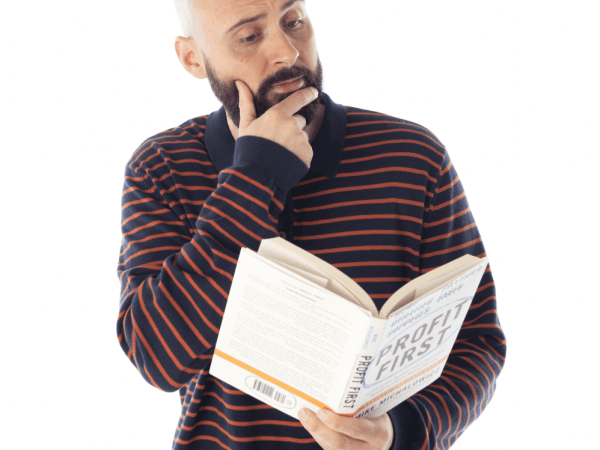

Free Profit First Book

🌟 FREE Complimentary “Profit First” Book! Are you struggling with your cashflow and your profits? Most business are… It’s time to turn the tables in […]

Find out more

7th April 2024 · 10 min Read

Accounting for Coffee Shops

Accounting for coffee shops with the Profit First Approach Accounting and bookkeeping is difficult. Coffee shops have unique challenges around the volume of transactions, dealing […]

Find out more

22nd March 2024 · 9 min Read

Comprehensive Guide to Share Purchase Agreements (SPA)

Navigating the intricacies of share transactions requires a meticulously crafted share purchase agreement (SPA). As a legal cornerstone, the SPA safeguards both parties with legislative […]

Find out more

16th March 2024 · 4 min Read

The Power of Intuitive Decision-Making in Personal and Business Growth

In the fast-paced world where external stimuli constantly bombard us, it’s easy to become ensnared in the web of seeking outside assistance for every decision […]

Find out more

8th March 2024 · 3 min Read

Having a 3D Mindset For Success

Hey there, entrepreneurial spirits and dream chasers! Today, I want to take you on a journey—a journey towards building a business that doesn’t just survive […]

Find out more

4th March 2024 · 18 min Read

Do You Really Need an Accountant for Your Limited Company?

Tackling the financial aspects of your business probably doesn’t top your list of favorite activities. It’s a common sentiment among entrepreneurs; managing the books can […]

Find out more

4th March 2024 · 7 min Read

The Essential Tax Guide for YouTubers in the UK: Sorting Your Financial Obligations

In today’s digital age, many embark on YouTube as a fun and creative outlet, only to find their passion projects evolving into lucrative ventures. When […]

Find out more

8th February 2024 · 3 min Read

Do Accountants Offer Business Advice? The Role of Accountants as Coaches

Introduction The role of an accountant in a business is often misunderstood. Many people believe that accountants are just number crunchers, but they are much […]

Find out more

8th February 2024 · 4 min Read

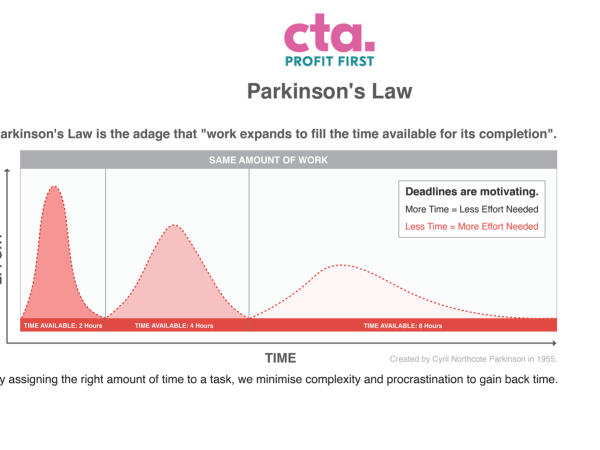

Leveraging Human Nature In Business with Parkinson’s Law Strategy & Profit First

Welcome to a deeper exploration of financial mastery, where we at CTA Profit First Accountants champion the revolutionary synergy between Parkinson’s Law and the Profit […]

Find out more

26th January 2024 · 2 min Read

Learn To Let Go In Order to Evolve As A Business Leader

The longer I’ve been in business the more I’ve realised that it makes sense to listen to my team more.Many organisations have internal politics to […]

Find out more

20th November 2023 · 4 min Read

The Power of the Impact Filter by Dan Sullivan

I share my thoughts, ideas and reflections many weeks of the year. I’ve decided that rather than skim the surface of several things I am […]

Find out more

30th October 2023 · 5 min Read

Chapter 2 – The Network Problem

This is Chapter 2 from ‘STOP BEING A BUSY FOOL (With the Entrepreneurial Freedom System) When I embarked on my journey with CTA, it was […]

Find out more

30th October 2023 · 4 min Read

5 Bullet Weekly Review – What Matthew Perry Tells Us

I’ve been quiet on my weekly reviews for a while as we’ve had some projects to focus on at CTA. I thought I would kick […]

Find out more

27th September 2023 · 10 min Read

Chapter 1 – The Mortgage Problem

One of the biggest problems with your entrepreneurial success is overcoming this first hurdle. We underestimate what we are capable of from day 1. Context […]

Find out more

13th September 2023 · 8 min Read

The Busy Fool System – Part 1 – The Mortgage Problem

The Busy Fool System – Part 1 – The Mortgage Problem This section (of the Entrepreneurial Freedom System Book) is not for the answers, it’s […]

Find out more

9th September 2023 · 4 min Read

Can You Really Make Money as a Coach? The Role of Accountants for Coaches

Introduction The coaching industry has seen a significant surge in popularity over the past few years. From life coaching to business coaching, health and wellness […]

Find out more

29th August 2023 · 2 min Read

5 Bullet Weekly Review – W/E 27.8.23

It’s back! My weekly review, musings, and inspirations. Let’s dive right in! My 5-Minute Coaching Sessions with Steve Jobs! You can learn more about this […]

Find out more

29th August 2023 · 2 min Read

5 Minutes with Steve: Lessons from a Virtual Mentor

You’ve probably heard the term “If I could just have 5 minutes with…”. Well, inspired by Napoleon Hill’s concept from “Think and Grow Rich”, I […]

Find out more

11th July 2023 · 2 min Read

5 Bullet Friday – 7 July 2023

Hope you had a fab week 🙂 Here are some of my learnings or updates from the last 7 days: Let your team or someone […]

Find out more

29th June 2023 · 7 min Read

The Entrepreneurial Freedom System – Book Introduction

Why This Book Exists This book has been in the making for several years. The intention was to release it by 2022, yet my focus […]

Find out more

27th June 2023 · 3 min Read

5 Bullet Friday – 23 June 2023

I’m trying to get back into the habit of my 5 Bullet Friday (sometimes sent on a Sunday!) emails. The idea is that I share […]

Find out more

21st June 2023 · 3 min Read

Introducing the Profit First Club: Boost Your Profits and Take Control of Your Finances

Hey there! I hope you’re doing fantastic and getting ready to embrace the second half of the year. Can you believe we’re already nearing July? […]

Find out more

21st June 2023 · 6 min Read

Embracing the Power of the Small Business Accountant: Your Financial Compass in the UK Marketplace

It’s a truth universally acknowledged, if you’re a small business owner in the UK, the words ‘small business accountant’ should have a special place in […]

Find out more

19th June 2023 · 9 min Read

What I learned from a month away from my business/work

How to Clockwork My Business Rule #1: I am Not an Accountant I am sitting here in Boston Tea Party (my favourite place in Cheltenham […]

Find out more

5th April 2023 · 5 min Read

Profit First or People First?

Profit First or People First? Profit First? Ew. A couple of weeks ago, the following email landed in our support inbox: “WOW…PROFITS FIRST? Really? Not […]

Find out more

4th April 2023 · 3 min Read

5 Bullet Friday 31 March 2023

Hope you’ve all had an amazing week. Here are my weekly insights/musings. Hopefully, something resonates 🙂 If you want my opinion or thoughts on a […]

Find out more

2nd April 2023 · 11 min Read

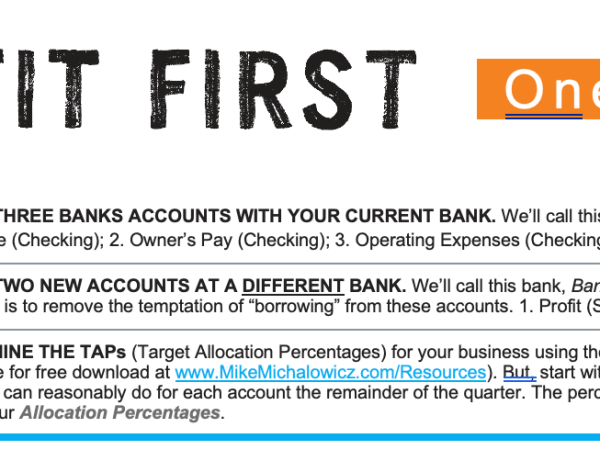

Profit First Bank Accounts

Profit First Bank Accounts What is Profit First? If you’re a small business owner, the concept of ‘Profit First’ may seem like an illusion or […]

Find out more

2nd April 2023 · 16 min Read

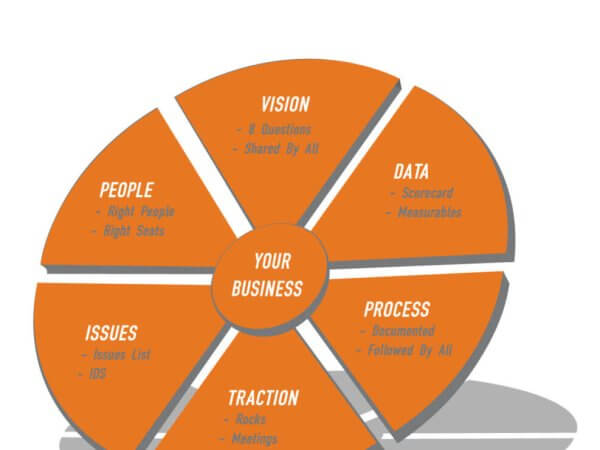

What is the EOS System (Entrepreneurial Operating System)?

What is the EOS System? The EOS (Entrepreneurial Operating System) system is a set of tools and processes designed to help business owners and leaders […]

Find out more

26th March 2023 · 3 min Read

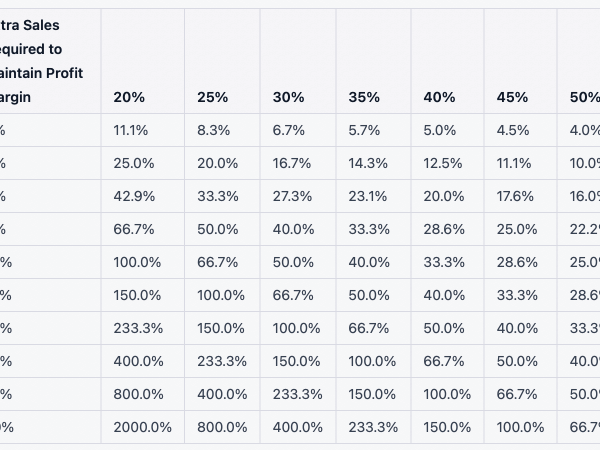

The impact of discounting on your business

How Discounts and Price Increases Can Impact Your Business’ Bottom Line Are you considering offering a discount or raising your prices? While it may seem […]

Find out more

23rd March 2023 · 4 min Read

The Power of a Mastermind Group

As an entrepreneur or business owner, it’s easy to get bogged down in your own thoughts and feel like you’re navigating uncharted waters. That’s why […]

Find out more

23rd March 2023 · 3 min Read

5 Bullet Friday – 17th March 2023

Hope you are all well. Here is another 5 Bullet Friday for you. Hopefully, there will be at least one thing that helps you in […]

Find out more

21st March 2023 · 4 min Read

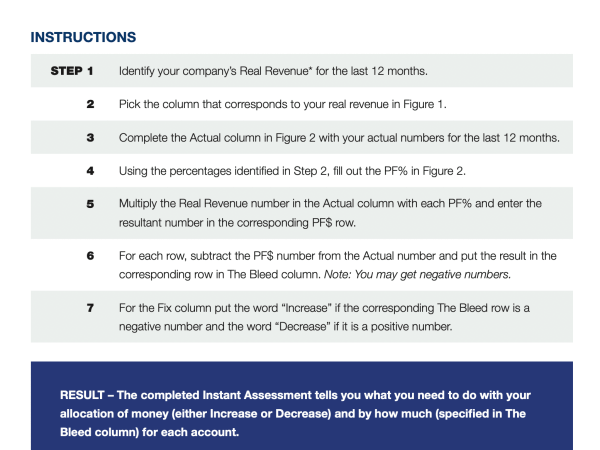

Instant Profit Assessment / Profit First Assessment

What is an Instant Profit Assessment? An Instant Profit First Assessment is a quick checkup of a business’s finances using the Profit First approach. It […]

Find out more

3rd March 2023 · 2 min Read

5 Bullet Friday 3 March 2023

Hope you are well. Here is another 5 Bullet Friday for you. Hopefully there will be at least one thing that helps you in some […]

Find out more

1st March 2023 · 6 min Read

What is a business scorecard?

Hey, fellow business owners! Have you ever heard of a business scorecard? It’s a pretty neat tool that can help you stay on top of […]

Find out more

1st March 2023 · 2 min Read

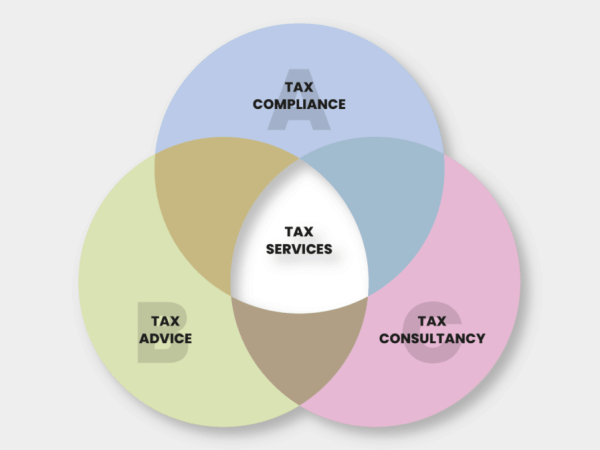

Box ticking accountants are dangerous

Hey, business owners! Are you considering hiring an accountant who only focuses on the ‘compliance’ work? Well, let me tell you why it’s not the […]

Find out more

3rd January 2023 · 7 min Read

Are You Ready for AI in your business?

Speaker 0 00:00:01 Hi guys. This is Steve and Edwards, the director of cta Profit First Accountants. So today I’m gonna talk about something that’s […]

Find out more

15th December 2022 · 4 min Read

What is an online tax account?

An online tax account is an online service provided by HM Revenue and Customs (HMRC) in the UK that allows individuals and businesses to manage […]

Find out more

5th December 2022 · 4 min Read

What are KPI’s (Key Performance Indicators)?

What Are KPI’s (Key Performance Indicators)? KPI’s are metrics used to measure the success of a business process or strategy. A KPI can be […]

Find out more

27th November 2022 · 6 min Read

Why You Need a Xero Expert / Bookkeeper / Accountant

There are so many online bookkeeping systems to choose from in 2022, how do you know which one is for you? Whatever you choose, make […]

Find out more

17th July 2022 · 3 min Read

One Page Business Plan

One Page Strategic Business Plan I promised myself I would reach out to our client base more often to add value where I can. This […]

Find out more

3rd June 2022 · 1 min Read

What is Profit First?

What it Profit First In this video, Stephen Edwards, Director of CTA Profit First Accountants provides you with an overview of the amazing Profit First […]

Find out more

16th April 2022 · 1 min Read

What to pay yourself as a limited company director for 2022/23?

What to pay a director in 2022/23? In this video, we discuss what to pay yourself as a limited company director for 2022/23? We will […]

Find out more

7th April 2022 · 8 min Read

How much does an accountant cost / charge in the UK? Accounts for self-employed and limited companies (Part 1)

How much does an accountant cost? (Updated 2024) How much does an accountant in the UK cost for small business owners and individuals? This is […]

Find out more

9th January 2022 · 1 min Read

6 BUSINESS LESSONS I’VE LEARNED FROM NARCOS

Learning Business from Narcos & Pablo Escobar I absolutely love Narcos. From watching the latest Narcos Mexico series I kept thinking that there is a […]

Find out more

20th October 2021 · 3 min Read

You’re not getting the tax advice you need

There’s an unspoken truth when it comes to tax advice: for business owners, there’s a complete lack of transparency from advisors over what tax advice […]

Find out more

23rd August 2021 · 1 min Read

E5 – What are Management Accounts?

What are Management Accounts? Why you may need management accounts in your business.

Find out more

16th July 2021 · 0 min Read

EP4: What is Cashflow Forecasting?

In this podcast we break down what a cashflow forecast is in nice plain English.

Find out more

8th March 2021 · 2 min Read

How to Pay Yourself as a Ltd Company – Directors Salary 2021/2022 – Dividends vs Salary UK

How to Pay Yourself a Directors Salary in 2021/2022 NI thresholds for salary 2021/22 Let’s first look at the 3 the NI thresholds to understand […]

Find out more

3rd March 2021 · 4 min Read

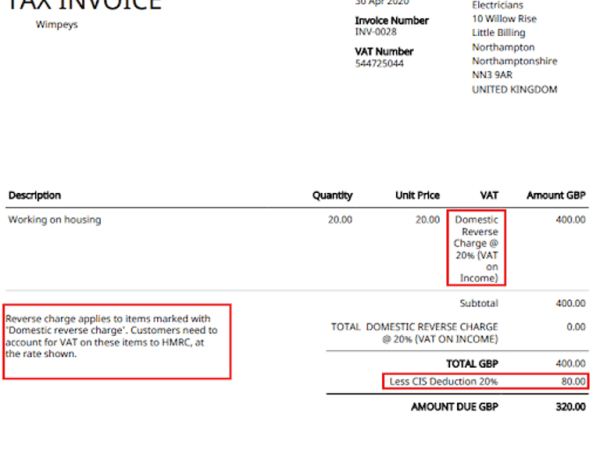

Reverse charge VAT

Reverse charge VAT Are you prepared for the VAT domestic reverse charge? The VAT domestic reverse charge procedure is a new way of accounting for […]

Find out more

26th February 2021 · 6 min Read

Bitcoin profit/Bitcoin taxes/ Bitcoin Trading UK

Do you pay taxes on Bitcoin profit in the UK? Stephen Edwards Stephen Edwards is a Chartered Certified Accountant and Director of Cheltenham Tax Accountants […]

Find out more

8th January 2021 · 1 min Read

The BUSINESS GROWTH CLUB – Episode 1

The business growth club to improve and grow your business In this very first session of the business growth have we cover what training content […]

Find out more

5th January 2021 · 1 min Read

How to prioritise your to-do list for the New Year with Steve Covey’s Time Matrix

Time matrix using urgency versus importance In this video I explain how you can plan which tasks and projects to prioritise at the start of […]

Find out more

12th August 2020 · 3 min Read

Business Continuity Plan & Recovery

What this article is about Business Continuity Plan? In this article we will look at what this means and how are you can maximise your […]

Find out more

11th August 2020 · 2 min Read

The Identity Iceberg

What this article is about In this article we will look at what the identity iceberg is and how you can relate it to your […]

Find out more

7th August 2020 · 5 min Read

Companies House Accounts / HMRC accounts

What this article is about in this article we will look into companies house accounts and what your responsibilities are as a director with a […]

Find out more

7th August 2020 · 3 min Read

Should I / Do I Need To Register for VAT

Should I register for VAT? Do I need to register for VAT? When you start a small business one of the major milestones is registering […]

Find out more

30th July 2020 · 5 min Read

What is a Bookkeeper?

What is a Bookkeeper? What is a bookkeeper and do I need one? This is a very common question that we get asked by a […]

Find out more

27th July 2020 · 3 min Read

Pub tax tips 2 – How to get a bigger tax/CIS refund/rebate

How to get a bigger tax refund/rebate How to increase your tax refund? One of the the most common things we hear from some clients […]

Find out moreTo Summarise...

We love what we do and care about your business and your money. Keeping our clients happy doesn’t just benefit you but also us, hopefully from singing our praises to friends, family and contacts…

Book an intro call!

We offer a free meeting worth £180 to see how we can assist with your accounting and tax affairs. To get started just call 01242 528412 or book an initial discovery through our form. Please pop your name, telephone and email to arrange an initial free call to see how we can help you.

© 2024 CTA Profit First